Should you get into Crypto?

Bitcoin, Dogecoin, Ethereum and now Internet Computer, are they worth it? I explore two things: what are the current ways to make money and what's my current strategy.

Update

With FTX and BlockFi also going bankrupt this is a much larger risk in this climate. I recommend doing your own research. One thing specifically to look into is decentralized services. Basically YOU want to own your assets should you decide to get into crypto.

Introduction

If you’re just interested in where to buy that is trustworthy I’ll cut to the chase, I recommend these two services.

Coinbase - great for beginners and decent access, has most coins.

Binance - great for access, has basically all the coins. Trading fees are a little less than Coinbase.

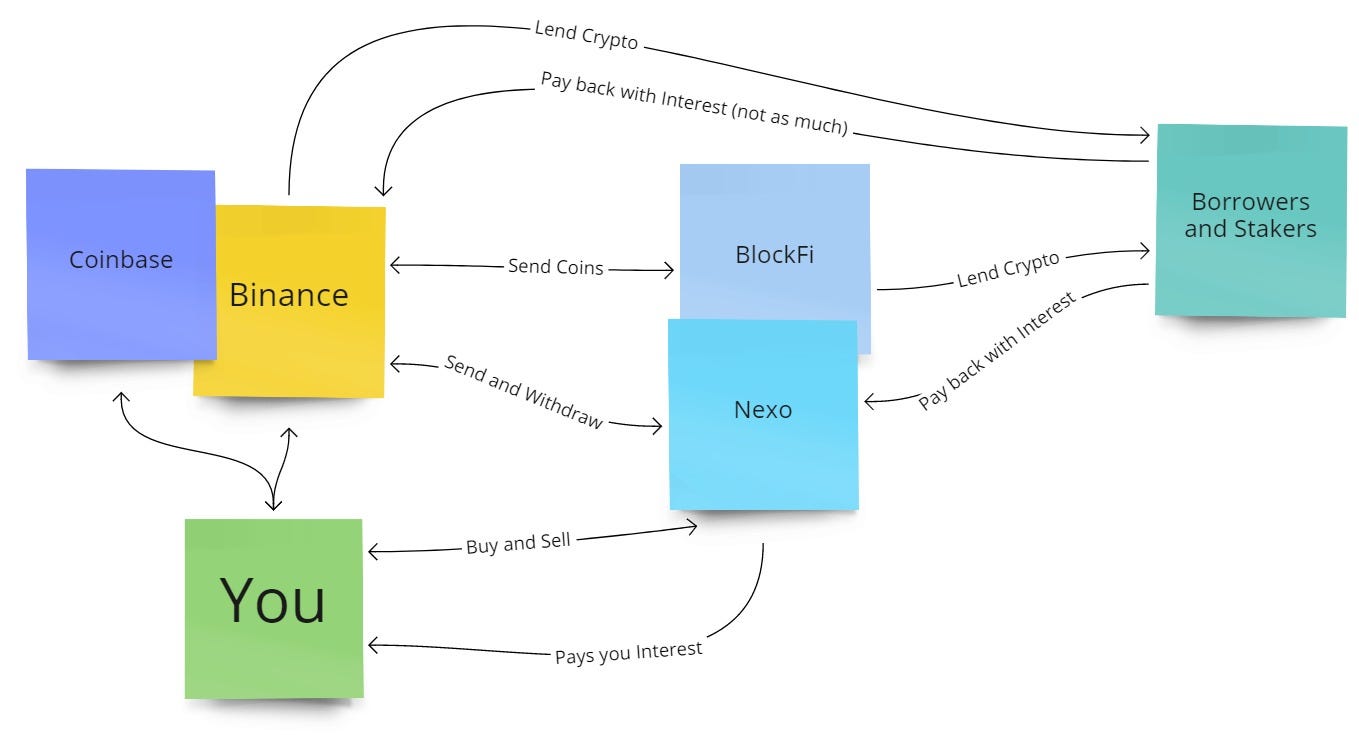

If you want passive income by earning interest 8-12% a year I recommend these two:

BlockFi - interest pays once a month. Best interest rates don’t require staking.

Nexo - interest pays every day. Has a staking option for an additional 2%, I personally do not stake.

I’ll provide more details later on. This article is broken into 2 parts:

Current methods of making money

My experience and my future strategy

If you don’t see a service here you’re currently looking into, I’m more than happy to try it for you first, let me know.

Current methods of making money

Three ways right now:

Buying low and selling high

Getting interest (up to ~12% per year)

Using crypto apps

I will also rank these: Hard, Easy, and Very Hard. If you’re still scared of crypto then the best thing I can recommend is try putting a very small amount of money in a service that gives you interest - it’s just like having a savings account except you can easily get something like 8% per year by doing nothing. But first, how do you get crypto to begin with?

Buying low and selling high [Hard]

This is your typical millionaire story. Someone bought Bitcoin or Dogecoin and years later they are rich, retired, and their main problem is deciding which fancy sports car to buy. This is not for everyone, I’ve never been able to do it well. Just like how there are millionaires, there are also people who have lost everything. I will always recommend not to buy more than you can afford. Everyone is different and everyone has a different risk tolerance. If you want to buy here’s what I recommend. Buy from your brokerage account or from a trusted exchange, but there are pros and cons.

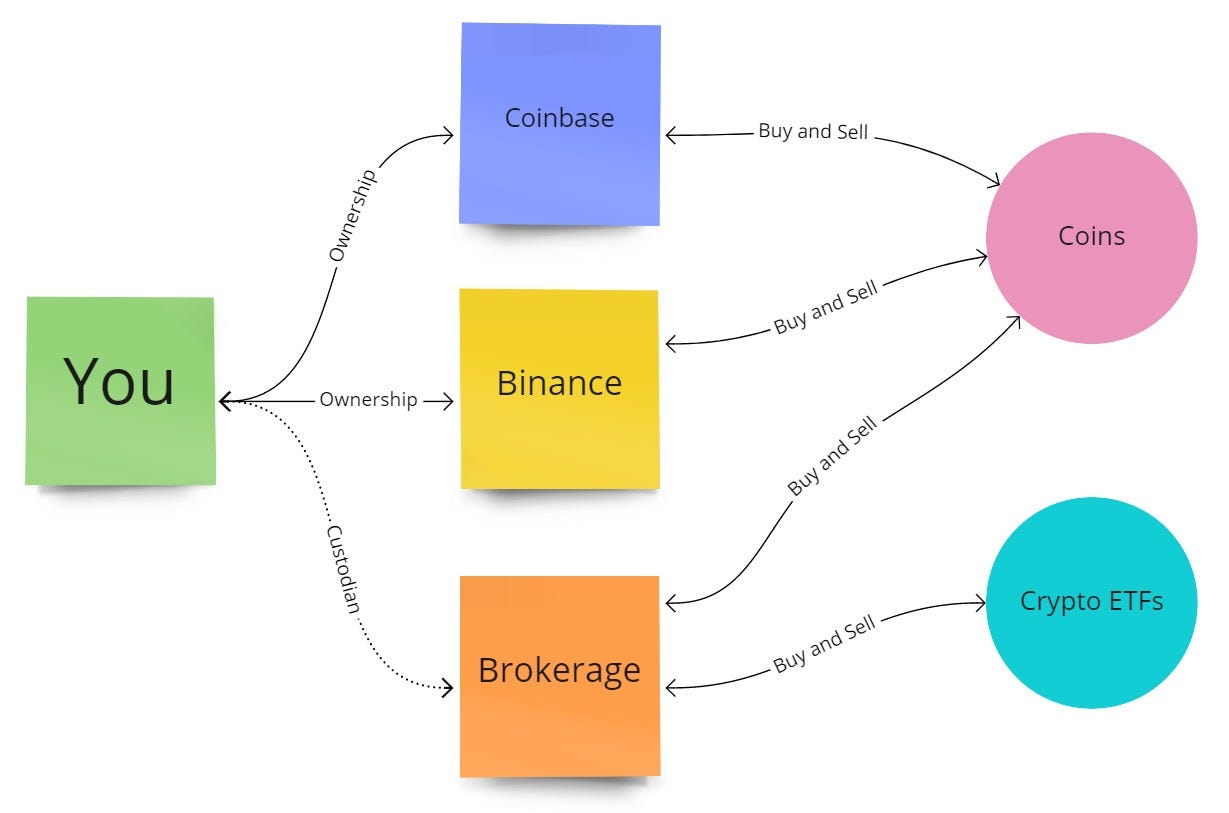

Your brokerage account

You can get exposure in your brokerage account now, you don’t have to learn all the crypto lingo if you don’t want to. To do this there are crypto ETFs, Coinbase stock (ticker COIN), and some brokerages let you “buy” the coins themselves. However their access is very limited so you’ll only have the main cryptocurrencies available and you don’t actually OWN the crypto. It’s like having a friend buy something for you and sell something for you. If you actually wanted to transfer the coins you can’t, your friend owns it. If you want to get interest on your crypto this method will not work, you’ll need to personally own the crypto by buying them. The upside is you don’t need to pay any transactions fees, or at least it doesn’t feel like you have to. The downside is a custodian is buying on selling for you so you can’t do anything with it, like earn interest which I’ll discuss later.

Buy from a trusted exchange

I recommend Coinbase or Binance.

Coinbase is great for beginners and has access to many coins. They are a public company now and very trustworthy. Binance is one of the world’s largest, if not the largest, exchange. It’s great if you want access to nearly all the coins. With both of these platforms you’ll own the coins - they belong to you. Binance’s trading fees are a bit less than Coinbase in my experience.

You’ll need IDs to verify such as a Driving License or Passport, I highly recommend that you use the same address that are on your documents. If Coinbase or Binance are not available in your country search for what’s the most popular platform in your country. Even if you don’t want to use one of these two there are other options, however I’ve been burned in the past and I personally don’t plan on using less established services. If you ever plan to truly own the coins I recommend picking one and sticking with it. Even if you use other sources, I recommend using Coinbase or Binance as your central hub source. Main reason is I don’t like giving my information to so many different places - I handle all my withdrawals through one place.

A quick note on trading fees. Some services may say there are no trading fees. I’m a bit skeptical but even if this is true, I’ve found that the prices don’t really reflect that. It may look like I didn’t pay any fees but it still feels like I paid a similar amount, if not more sometime. When it comes to crypto, get used to trading fees.

One more important thing, cryptos also give you access to other currencies, specifically I want to call out the pound sterling £, Euro €, and US dollar $. In fact it’s easier in my opinion to buy currencies through crypto than it is by other means. There are cryptos called stable coins, these are tied one-to-one with the currency. So for example 1 USDC = $1 US dollar. So you might see where this is going, if you want to buy another currency in hopes you can sell it for more of your home countries currency later, this is another way to do it, which you can do with Coinbase and Binance.

Getting interest (up to ~12% per year) [Easy]

This is the best way to hold your coins long-term. You can treat it like a savings account that earns interest, except it’s going to get way more interest than you can get with any savings account today. In fact it’s exactly that, there are companies that give you interest on the coins you own. Coinbase and Binance offer these services but the interest rate on them is much less than desired or there is a waitlist. I have three cautionaries notes.

The first note of caution, anytime you see an interest rate of 10% or more, you generally need to “stake” - or buy and hold another coin. These coins are usually that company’s coins so I do not believe in their liquidity or value. Another reason I’m not a huge fan of this is because I tried it once and didn’t feel like the interest I was earning outweighed my holding a coin I didn’t know much about. You can still get interest but it won’t be their “premium” rate which is fine for me, still more than a savings account. If you browse the websites long enough or even make an account, you’ll quickly see this type of requirement.

The second note of caution, if any service says you can’t withdraw while it earns interest and you need to leave it for months at a time, I wouldn’t use it either. The two services I use let you withdraw at any time (one free withdrawal per month, any more than that in a month are charged a fee).

Those two services I trust are:

BlockFi - interest pays once a month.

Nexo - interest pays every day. Has a staking option for an additional 2%, I personally do not stake.

Now my third note of caution. I used another service for about a year and it went bankrupt. They are still in bankruptcy proceedings and I don’t expect to get my money back. After that experience I started looking at companies with a track record and a lot of backing, with the ability to withdraw your money whenever you want, and I tested with a little bit of money at first. Now I hold a portion of my savings in these services since the interest rate is really good.

If you are scared to hold volatile cryptos, you can also hold stablecoins. In fact the stablecoins usually get the most interest and that’s exactly what I do, it’s basically a high interest savings account. If you are scared to try BlockFi or Nexo, you can stick with Coinbase and Binance and they have interest options as well, the interest rate is just much lower. However those two are the most trustworthy platforms that exist, so worst case scenario buy some stablecoins like USDC and just let it grow interest.

Using crypto apps [Very Hard]

Crypto has come a long way, there are not crypto apps, also known as decentralized apps, also known as dapps. There isn’t that much different between a regular phone or computer app and a dapp except you have to link your crypto account to the dapp. Paying for something with crypto does not make it a dapp, so there aren’t really Bitcoin dapps since it can really only make payments. Ethereum is generally what most dapps are built on, there are many many others out there however such as Filecoin or EOS that have their own rules. I won’t go into too much detail about any one of them but there’s generally three models from what I’m seeing and I should note: this is the hardest way to make money. The three models are:

Games that let you buy, create, and sell things

Gambling

Nonfungible tokens or NFTs

The games that let you buy, create, and sell things are generally collector like games. They don’t have anything close to the gameplay you’d see in the most basic mobile games today. They are simple game play mechanics that let you create items with marketplaces that let you sell those items. Think of a mobile game you play, imagine if you can sell your items to others for in-game currency and that’s the same idea. Because coins have real world value and most apps just have in-game currency with no real world value, I found these marketplaces very hard to make a profit. I can’t imagine many people are playing these games to have fun, just download something from the Android or Apple store if you want to have fun. So I don’t recommend it but you can make decent money if you’re one of the few top players in the game. There are a few games out there trying to be something, for example a trading card game where there’s only a set amount of digital cards.

If you’re a gambler check out a gambling site - also make sure it’s legal in your country. I am not a gambler, I get too anxious. I played for a bit to see what it’s like but long-term I know I will not sleep well if I keep doing it. Not for me but if you are a gambler check it out. The main games I see are dice games.

NFTs are very hot right now. If you’re a great artist I actually do recommend you look into this. If you can make digital artwork and make it well, there are a lot of marketplaces for you to explore NFTs. If you’re someone who likes to flip items then that’s a different story. I don’t have great advice there since you’d need to take some time to learn the market. Currently I’m flipping NBA top shot moments and that’s starting to not be profitable. There’s a few NFT marketplaces out there which have a flurry of activity. I can’t say I completely understand what is good and what isn’t, but there are certainly folks who are cashing in big time.

My experience and my future strategy

I am not a crypto millionaire. I own some and I even own NFTs, I know enough about crypto to tell you that I prefer Ethereum over Bitcoin, I’ve played with some crypto apps (also called dapps), and I’ve even tried mining. I however never decided to put my life savings into it and become filthy rich. I first got into Bitcoin in the early 2010s when I heard of the first spike to $1000. I didn’t know much about it except I read a few analyst reports at the time from the investment banks that said it could never go above $1300. In the next two summers I found myself trying out several new applications. Coinbase wasn’t public then and I started trading Bitcoin futures on OKCoin. I made some and lost some and got really scared. I decided to leave it alone after a while and then then next spike happened. It seemed like every day there was a new crypto millionaire and that could have been me if I just left it in there. Sadly I’m not and I didn’t touch it for several years.

In the last several years I was lucky enough to have an employer pay me to try them out. I played with some dapps and even tried mining. There are several coins trying to be more than just a currency, for example Filecoin lets you lend out space on your computer and pays you to do so. In general I felt that everything was a bit too complicated. Brave Browser is another good one and it earns consistent money every month, I have an article about that as well. When you buy something today maybe you use cash, a credit card, or your phone - it feels seamless. With cryptocurrency whenever you purchase something there’s a huge feeling of anxiety. You aren’t sure if the transactions gone through and you have to learn new concepts. For example with Ethereum there’s “gas” which is essentially a price for the transaction. When you pay for something you just want to hand them one thing, money. It feels weird and it hurts to think about when you have to also now think of additional concepts you need to pay for, handling wallet address can already make you sweat.

All in all this is when I decided that if cryptos are the future, they need to feel more like money. Most people like myself are looking at it as an investment. Should I put $1? or $100? or maybe $10000? I don’t know. My strategy is to find a few features of coins I believe in and I buy a recurring investment every month of a small amount. The reality is if someone years ago said I’d never touch that they were wrong. I’m not saying you should put your life savings in there, but even a $100 investment in Dogecoin at the start of this year could have been $20000. I am somewhere in the middle. Personally I believe in Ethereum the most. I don’t think it’s quite 100% the future but it’s the closest to it from what I’ve seen. Bitcoin is too energy intensive and takes too long to process a transaction. Ethereum has “smart contracts” which is essentially programmable money. This is a very hard concept to explain and I’m not sure I fully understand, but my short version is I can write the program on Ethereum and when you pay for something it runs the program. Imagine if you were to buy food, instead of having to order the food, when you send the money all the ordering is done for you - the money “knows” what to do. It’s also faster than Bitcoin and moving towards something called Proof of Stake that will make it more energy efficient and faster.

I tried a lot of different companies, some that were hacked and some that went bankrupt. After all this I wanted to share my strategy and what I find trustworthy.

To summarize, I buy a little each month, anywhere between $10 - $500. I put half in stablecoins that gain interest, and the other half in Ethereum. I’ve got a budget that I’m allowed to use to try out dapps and NFTs, again not looking to make money but to keep learning about the applications of cryptocurrencies. This is also why I recommended using Coinbase or Binance as a central hub, it is my gateway to using coins, buying and selling, and earning interest instead of having to verify across all the different services. I’m not looking to get rich from this but I do want to share some current methods along with a few of my own referral links for what I find to be the most trustworthy.

There’s so many more topics I can get into but as an intro this is already more than enough. If there’s any more excitement or folks want me to go into those I will gladly do so, and if there are any services people want me to try first I will as well.

If you'd like to donate to India here's the crypto relief fund link! There's already $1 billion donated.

https://cryptorelief.in/donate

Bhai Ami kamon Kore diamond